BRA-AFRI: medicines industry (synthetic and phytosanitary)

Vision:

To be the industry of development of world ESSENTIAL and INNOVATIVE formulas from the resources and needs of the population of the African Continent.

To be the LEADING drug industry in Angola – Africa.

Mission:

To promote health, well-being, beauty and longevity to the peoples of the African Continent in general and in Angola specifically, with quality products that are accessible to all audiences.

To research, develop and manufacture DRUGS with versatile, original and eccentric raw materials, derived from African culture and flora.

To manufacture various drugs and pharmaceuticals with the mission of improving the quality of life of the African people, researching their way of life (social sciences), anthropology, their eating habits and their main diseases. The main mission is to bring health and a better quality of life to Africans.

What makes it different from all the other industries in the market?

Research and Development of original formulas with Africa seal (AND UNITED NATIONS SEAL). This activity will be carried out primarily by the independent laboratory linked to the company’s activities.

To be the first pharmaceutical industry in Angola. With integrity in the origin of its raw materials, and generate reliability in its production methodology.

Another differential: to manufacture phytotherapic products using African and Brazilian plants. To take advantage of the biodiversity of the two continents.

Values:

Improvement of the quality of life and health of Africans;

Commitment to ethics;

Defence of African culture;

Reliability and regularity of delivery

Commitment to health, culture and people.

Innovation.

Objectives:

1. INDUSTRIAL: To manufacture and distribute generic formulas from Brazil. Brand: GINGA GENÉRICOS.

2. BRANDING: To set up an ”umbrella” of brands with formulas and segmented marketing positioning, differentiated in ANGOLA: which is aligned with the African continent, culture, economy, consumer psychology. Since the international brands, Nivea, Loreal, Neutrogena, La Roche etc. do not ”enter” in Angola neither with industry nor with their aggressive marketing, therefore, there is the market space, the market share, to create products and launches of best sellers under the group’s own brands ”BRA-AFRI”.

3. COMMERCIAL: To buy and to distribute complementary medicines to our portfolio in order to ”close” the market for not the entrance of potential competitors.

4. R & D: Research, develop, manufacture PHARMACOS with versatile raw materials, original, eccentric, provided of the African culture and flora. Selling these formulas, manufacturing or exploiting royalties: R & D company.

5. INDUSTRIAL: farms: in order to obtain raw materials in Africa, it is necessary to promote agriculture and balance the harvest. Objective: to plant raw materials that will be harvested by industry. FOSTERING ALL THE ECONOMIC CHAIN: from the plantation, to the handling cooperative, to the purchase by the industry of these raw materials. Encourage farms, agriculture, so that ANGOLA is not only “hostage” to the oil and diamond economy.

6. INDUSTRIAL: Punctuality: To have enough working capital to pay for the deficiency of raw materials from the African continent, which, in principle, cannot be obtained: we will have to import them.

7. INDUSTRIAL: Manufacture generic formulas from Brazil. Set up a brand of Brazilian generics, a brand “commodity”. Formulas and brand positioning are intertwined so that all the formulas of the industry ́ ́BRA-AFRI ́ ́ will not be placed in the same generalized portfolio, but in a brand in which the products are aligned with the African continent, culture, economy, consumer psychology;

8. R & D:Research, develop, manufacture Pharma drugs with versatile, original, eccentric raw materials, provided from African culture and flora; TO OBTAIN RAW MATERIAL IN AFRICA, SHOULD FOMENT AGRICULTURE AND EQUILIBRATE HARVESTING. Objective: planting raw materials that will be harvested by industry. FOSTERING THE WHOLE ECONOMIC CHAIN: from the plantation, to the handling cooperative, to the purchase by the industry of these raw materials;

9. INDUSTRIAL: To have enough working capital to pay for the deficiency of raw materials from the African continent which, in principle, will be imported;

10. R & D:To produce PREMIUM/INCOMING FORMULAS exploring, researching, prospecting AFRO and Brazilian raw materials, in principle, original ones;

11. R & D: Formulate special blends using Brazilian raw materials with mix of various molecules aiming to add value to better serve the customer;

12. R & D: To keep industrial secrets.

13. R & D: Form Association with Brazilian universities (technology transfer) and African universities;

14. R & D: Form Association with African tribes (technology transfer in a certain way). Create a classification of the tribes, which have this profile, so that we can make an organized business communion, THE FORMS APPROVED FOR COMMERCIALIZATION WILL PAY ROYALTIES ON THE EXPLORATION.

15. INDUSTRIAL:Stimulate the planting of vegetable species that will supply raw material for the phytotherapics, allowing a preservation of the environment, improving the planet’s oxygenation and stimulating the family agriculture in the 2 continents, and in the agribusiness;

16. R & D: To specialize in ”mono”, unique, professional products, such as musical singles with high sales power. THESE AUTHENTIC FORMULAS AS THEY DISRUPTIVE to win prizes. A product with its own mould, nécessaire, premium formula. Ours. This same formula can be CO-BRAND manufactured for the chain of distributors who want their own brand (as long as you bring each of them 1 of our same competing product).

17. INDUSTRIAL: Set up an association or cooperative for processing raw materials from farmers. The cooperative will be part of the group of possible companies in the industry.

18. INDUSTRIAL: Odd formulas: Form partnerships with the government to manufacture specific formulas which the lower-medium competition is unable to supply.

19. INDUSTRIAL: Produce BULKS for export: Import foreign brands the formula. And inject into their bottles.

20. Market in networks of distributors in African countries where, possibly, there will be a monopoly of some master distributor… This distributor will buy the drugs with PRIVATE LABEL, their labels and our formulas. A WAY TO ENTER THE ”CLOSED” COUNTRIES.

21. COMMERCIAL: Map, analyze, and prospect wholesalers, so that our entire commercial is outsourced;

22. COMMERCIAL:Participate in international fairs by visiting international competitors at the fairs, commercials, who may become potential large clients.

23. R & D & COMMERCIAL: Study the behavioural, social, sanitary, pathological profile of the inhabitants of each COUNTRY and their most urgent, basic and specific needs. Specialise in this behavioural niche. Example: ANGOLA;

24. R & D: Pursue international awards, being an awarded, starred industry, or with clients that are starred because of the projects sold to clients, coming from the products, formulas, management, being able to be a player in the world market related to the pharmaceutical industry.

CHEMICAL INDUSTRY.

The chemical industry contributes $ 5.7 trillion to global GDP and maintains 120 million jobs. The chemical industry plays a key role in regional economies in all parts of the world.

What is the importance of chemical industries?

It is an industry that supplies others with inputs and raw materials and for this reason it is one of the largest in the world. According to Oxford Economics, the chemical industry represents around 8% of global manufacturing GDP and is responsible for the employment of around 120 million professionals.

Which is the largest chemical industry in the world?

BASF is the largest company in the global chemical industry, with sales of 60 billion (European Portuguese), 60 billion (Brazilian Portuguese) euros in 2017, from 113,000 company employees in the more than 390 production sites in more than 80 countries.

What are the main segments of the chemical industry?

Inorganic chemicals; organic chemicals; resins and elastomers; man-made and synthetic fibres; pesticides and household disinfectants; soaps, detergents and cleaning products; cosmetics; paints, varnishes, enamels and lacquers; adhesives and sealants; explosives; additives and catalysts.

PHARMACEUTICALS INDUSTRY

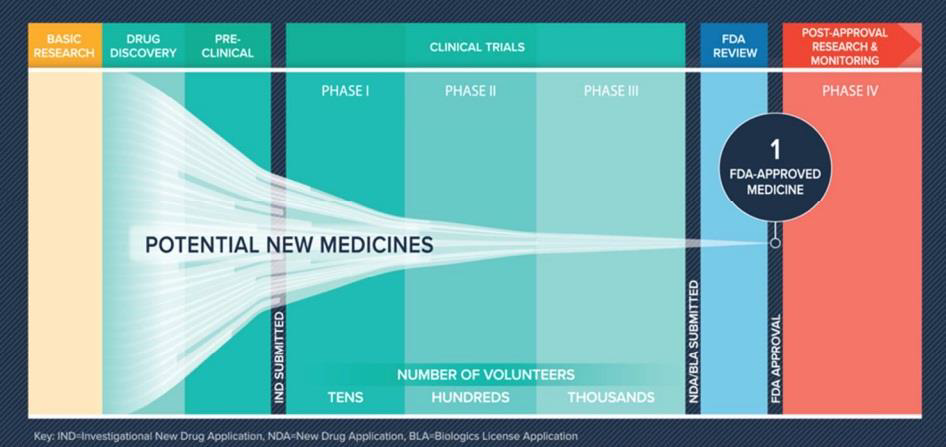

Although, to the general public, the pharma industry seems somewhat unique, it has different branches with different attributions and forms of profitability, namely, R&D (Research and Development) companies that profit from the performance of their assets and stock exchange, API (Active Pharma Ingredients) companies and Generic Manufacturers.

With the advent of the idea of generics, the general public mistakenly thought that it was about increasing competition in the pharmaceutical market, but, as we shall see, this is not what happened. We have predominantly an outsourcing of less profitable activities to smaller and regional companies. In this sense, the entry of new players in the market, depending on their insertion, is welcomed by the market in general, and in particular. Africa is a space to be conquered.

Hodiernamente, the indication of generics began to be adopted by most doctors in the world, but the standards of treatment are still very different and are marked predominantly by the training of the professional. In the case of Angola, the training has traditions of training, and consequently of indication of drugs, in Cuba, Brazil, Portugal, Russia, among others. With this, the small protocolization? of treatments, and greater freedom for the professional.

In recent years, the first modification in this framework was the creation AMA (African Medicines Agency) in 2019. Before we had productions in South Africa and Egypt, in 2013 SADC (Southern Africa Development Community) had introduced ZaZiBoNa (Zambia, Zimbabwe, Botswana and Namibia) to facilitate joint registration of medicines. Currently with 13 of the 16 SADC members, Angola does not actively participate, but has deposited protocols.

Also, in the area of international regulation for sales and exports, the PIC/S (Pharmaceutical Inspection Co-Operation Scheme) encompasses countries with a tradition in R&D and API. Only South Africa is a member within the African continent and Brazil is applying for membership. The main contribution of PIC/S is the standardisation and guidelines for the harmonisation of Good Practices of Manufacturing (GMP). Many countries consider drugs safe for use by approval in two or more PIC/S members, which in practice reduces the market for R&D and API to the big players. Angola’s entry into this select hall would allow Angolan pharmaceutical products the following advantages:

➔ Reduced duplication of inspections;

➔ Reduced costs;

Facilitation of exports;

Better market access.

The European market is protected by the Supplementary Protection Certificate (SPC) barrier, but there is no equivalent sanction for products of European origin on the continent. The European market is protected by the SPC (Supplementary Protection Certificate) barrier, but there is no equivalent sanction for products of European origin on the continent.

The North American market, on the other hand, is open in two ways: the ANDA (Abbreviated New Drug Application) and the 505(b)(2), which was not necessarily created for generics. In the ANDA, competition is fierce, so many laboratories have used modified formulations and applied through the 505(b)(2) to maintain a differential and establish a favourite brand.

Per 505(b)(2):

1. Relatively lower risk due to prior approval of the drug;

2. Lower cost, accelerated development due to fewer studies;

3. May be eligible for three, five or seven years market exclusivity.

Thus we have three ways:

1. 505(b)(1) Full NDA application – Data predominantly obtained from studies conducted by and for the sponsor;

2. 505(b)(2) NDA – Hybrid between an ANDA [505(j)] and a full NDA [505(b)(1)];

3. 505(j) ANDA – Appropriate for medicines that are the same as approved products.

Problem resulting directly from the pandemic of COVID. As with food safety, the doctrine of pharmaceutical safety has produced direct investment in Europe and the USA in the recovery of the domestic consumer drug industry. as a consequence supply to the export market has been reduced.

In the domestic market, the main competitors are the generic products of Indian, Chinese, Turkish Bengali, Egyptian and Brazilian production. These are also the direct competitors in the international market in the generic sector.

As for the API Market, much more restricted, constitutes, in its essence, of Biopharmaceuticals such as monoclonal antibodies, recombinant growth factors, purified proteins, recombinant proteins, recombinant hormones, synthetic immunomodulators, vaccines, recombinant enzymes, among others, which make up the raw material for pharmaceuticals. Today, China is their main producer. During the pandemic of COVID, this heavy reliance on a single source of production proved to be strategically very risky. The US, for example, reactivated the bankrupt Eastman Kodak just to make up for this dependence. Angola would not, at the moment, be able to act in this segment due to the lack of professionals and the long time of experience and sectorial regulation to be able to establish practices consistent with international standards, besides having to compete directly with much more powerful economies. However, it is always an ideal to be pursued in the search for pharmacological safety, as mentioned above.

The third pharmaceutical sector invests in the Growth Potential of the Biological Manufacturing Industry through R&D. This model is even more utopian on the African continent, due to the lack of speculative capital systems. Equally uninteresting for a continent that still suffers from diseases whose cure is already known. On the other hand, there is anthropological knowledge that is coveted by the large R&D laboratories, and that Joint Venture agreements or the simple sale of patents can become a profitable source for the country, safeguarding the compensation due to the original peoples and their knowledge and reinforcing national sovereignty. In other words, by systematically combating biopiracy, the country would have much to gain from organizing research in its territory. And a national pharmaceutical industry would be an important ally of the State in the pursuit of this goal.

From three to ten new active principles are presented each year, fruits of long researches that take up to decades. Each one of these laboratories programs its launch to the time and convenience of the profits and not the conclusion of their researches. The logic is not cure, but monetisation of research potential. The price erosion of launches averages 90% in the year following the launch. Thus, even under patent, it is common for the laboratory to give it up at the end of this period or even earlier.

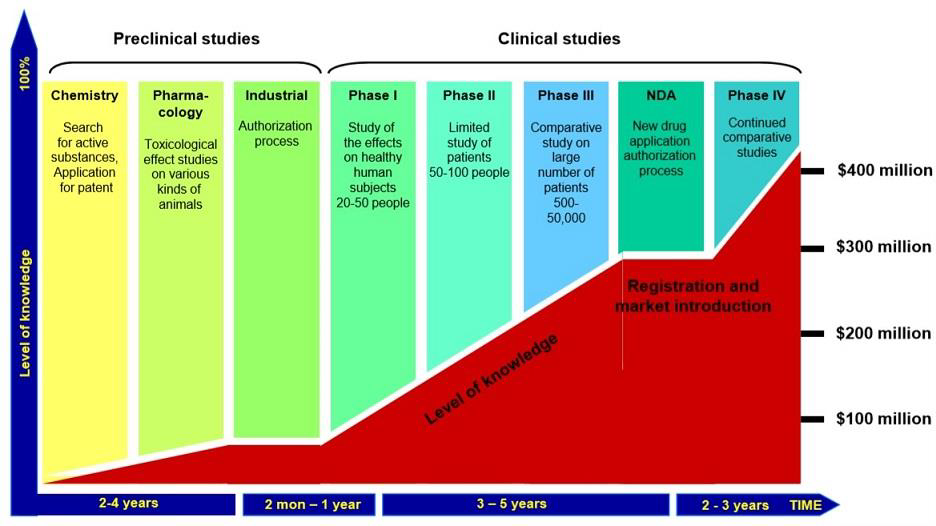

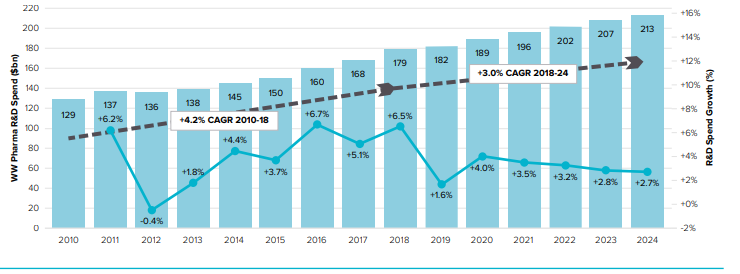

Graphs: Aseem Chauhan et alli. Future of Pharma. A Foresight Study-2030, Centre for VUCA Studies, Amity University, p. 83-84.

R&D is sponsored by big pharma but not necessarily operated by them. There is a system known as CDMO (Contract Development & Manufacturing Organisations), whose value chain we see in the chart below:

| ➽ | ➽ | ➽ | ➽ | |

| Research Contract | Development | API Production | Formulation | Packaging |

| Identification Targeting | Drug Development | Extraction | Solids | Injectable |

| State-of-the-art Research | Source | Synthesis | Semi-solids | Controlled Release |

| Medical Chemistry | Cell Sequencing Development | Small Fermentation Molecules | Non Sterile Liquids | Others |

| preclinical (in-vivo & In vitro) | Scale-up | Large fermentation molecules | Esterile Liquids | |

| Clinical testing phase I-IV* | Technology transfer | Other Methods | Other finished doses | |

| Formulation development |

1. CDMOs operate at the top of the global pharmaceutical value chain, where profitability is higher than generic exports.

2. These are high-tech oriented operations and can provide a lot of staff expertise that can seed other firms.

In short, companies in the R&D segment operate, alternately or simultaneously, with two types of profit: sometimes as outsourcers of the research process, profiting with the added value in each phase of the process; sometimes as an actor in the financial market, by the valuation of their papers in the stock exchange, mainly with launches with market capture.

The reduction in R&D spending may be an indication that companies are investing now to improve their future R&D efficiency. The use of real-world data combined with machine learning techniques, as well as collaborative R&D programmes, are some of the initiatives employed by companies to help them stay one step ahead in an era that demands more patient-driven drug development. Similarly, this reduction in R&D spend may be an indication that less revenue is being directed to replenish the pipeline.

The pharmaceutical industry continues to spend heavily on R&D (around $140 billion per year), resulting in 30 to 40 new drug approvals each year, a return on investment that is not as strong as one might expect from investment. The industry is an example of a “business as usual” approach.

In addition to the formal industry, there is also that traditional herbal-based industry. With less regulation, often with food rather than drug protocols, it is also a very popular product among poor people and countries with poor distribution of pharmaceuticals, such as Angola. Which does not mean stigma, and can even be developed luxury line, linked to ideas of nature, healthy, beauty etc..

Finally, there are prophylactic and cosmetic products, including UV blockers, mosquito repellents, moisturising creams and much more. Depending on medical regulation, with popular consumption and differentiated distribution.

The personal care, perfumery and cosmetics industry is generally classified as a segment of the chemical industry due to the use and synthesization of ingredients (BNDES,

2007). According to the Chemical Industry Association, this industrial segment corresponds to more than 12% of the global chemical industry production (Garcia et al, 2000). The basic activity of this industry is the manipulation of formulas and can be divided into three segments:

★ Personal Hygiene, which is composed of soaps, oral hygiene products, deodorants, sanitary pads, shaving products, disposable nappies, talc, hair hygiene products;

★ Cosmetics, which is comprised of hair coloring and treatment products, hair fixatives and styling products, make-up, sunscreen, skin creams and lotions, depilatories;

★ Perfumery, which includes perfumes and extracts, eau de toilette, aftershave products.

Forces shaping the pharmaceutical industry landscape

World’s largest pharmaceutical industries:

| Rank | Company | Sales (USD millions) | Headquarters |

| 1 | Pfizer | 43,363 | USA |

| 2 | GlaxoSmithKline | 36,506 | UK |

| 3 | Novartis | 36,506 | Switzerland |

| 4 | Sanofi-Aventis | 35,642 | France |

| 5 | AstraZeneca | 32,516 | UK |

| 6 | Hoffmann–La Roche | 30,336 | Switzerland |

| 7 | Johnson & Johnson | 29,425 | USA |

| 8 | Merck & Co. | 26,191 | USA |

| 9 | Abbott | 19,466 | USA |

| 10 | Eli Lilly and Company | 19,140 | USA |

| 11 | Amgen | 15,794 | USA |

| 12 | Wyeth | 15,682 | USA |

| 13 | Teva | 15,274 | Israel |

| 14 | Bayer | 15,660 | Germany |

| 15 | Takeda | 13,819 | Japan |

| Socio-environmental Forces | Technological Environment Forces |

| A maturing concept of value: Most customers will now define value in terms of health benefit per unit cost. | A second therapeutic revolution: The number and effectiveness of pharmaceutical treatments will increase significantly, but new treatments will be more specific and relatively more expensive than in the past. |

| A larger and more fragmented market: There will be more customers and they will vary more in what they want and how they buy. | A Blackberry world: Information and communications technology will provide new ways to deliver and use healthcare, including pharmaceuticals |

| A more risk-averse market: Customers will continue to become less tolerant of the risks associated with healthcare. | New research and development technologies: New methods of organisation and new information management will improve the effectiveness of research and development. |

| A stratification of health provision: The reduction in state provision will lead to a stratification of health service provision. | The efficiency imperative: New ways of organising production and the supply chain will enable efficiency to be improved and demands for quality and risk management to be met. |

| A more informed, sceptical and proactive public: Lay people will continue to become more informed about medical issues, less likely to submit to medical authority and doubt the motives of for-profit organisations. | Death of a traditional vendor: New organisational structures will replace traditional methods of marketing and selling pharmaceutical products and will be enabled by information technology. |

| Contemplative investors: Investors will reassess the place of pharmaceuticals in their portfolio, become more risk-sensitive and less willing to grant executives freedom of action. | |

| A more preventative approach to healthcare: Both patients and providers will become more willing to invest directly and indirectly in prophylaxis. |

Seven Social Changes

The way the social environment is changing to shape the evolution of the pharmaceutical industry. This information was, as management researchers like to say, “confusing and unstructured”. Interviewees answered the same questions, but from different perspectives. Even when they talked about the same thing, they often used different terms, put things in a different order of priority and drew different conclusions from what they observed. The issues that arose were also strongly interconnected. For example, important points such as loss of patent exclusivity, generalisation and price pressure were often intertwined in the interviewees’ responses. However, through careful analysis, seven dominant themes emerged and these seven dominant themes will be used to structure the remainder of this chapter. In a rough order of importance, the seven forces of the social environment that are shaping the evolution of the pharmaceutical industry are:

– A maturing value concept;

– A larger and more fragmented market;

– A more risk-averse market;

– Stratification of healthcare provision;

– A more informed, skeptical and proactive public;

– Contemplative investors;

– A more preventative approach to healthcare.

AFRICA:

In the area of drug manufacturing capacities, there are at least 649 factories in Africa Today. The countries with the highest number of factories are South Africa (122), Egypt (120) and Nigeria (150). North Africa exceeds all regions in the number and complexity of formulations and technologies Capabilities.

There are four countries with vaccine manufacturing operations in Africa. These are Egypt (Vacsera), Senegal (Institut Pasteur de Dakar), South Africa (BioVac) and Tunisia (Institut Pasteur de Tunis). Morocco once had vaccine factories, but ceased operations in 2001.

There is very limited capacity for the manufacture of active pharmaceutical ingredients (APIs) for drugs and active ingredients for vaccines in Africa. South Africa produces APIs for paracetamol, codeine and a cancer drug. There is some capacity for the production of active substances for vaccines in other countries, while for Medicines, the entire continent (and globe) is essentially dependent on APIs, mainly from China.

Business models in the sector could be rethought in order to strengthen localisation efforts. Our study points to four types of business models for the pharmaceutical industry on the continent, with most based on the generic drug business model, which is premised on low value products and therefore requires a low cost base for competitive success and business sustainability.

Although drug regulatory capacities are prevalent on the African continent, institutional capacities and strengths of regulatory bodies vary across countries, which hinders the growth of the sector. Regulation is important to ensure the safety and efficacy of the technologies used in the sector. According to WHO, there are 54 National Medicines Regulatory Authorities (NMRAs) in Africa, although only 7% of these have the necessary capacities to perform the essential functions expected of NMRAs.

Which regulatory bodies in the pharmaceutical industry?

Key players in Africa’s pharma industry

In Africa too, a land of small fragmented markets has made pharmaceutical production unattractive for local manufacturing. With the launch of the giant African Continental Free Trade Area (AfCFTA), following the signing by 52 out of 54 countries, the stage is set for large-scale production and export of formulations within the continent to take a larger share of the $60 billion market by 2030.

According to Goldstein Research, Africa is the only pharmaceutical market where genuinely high growth is still achievable, the value of Africa’s pharmaceutical industry jumped to $28.56 billion in 2017 from just $5.5 billion a decade earlier. This growth continues at a rapid pace: we predict the market will be worth $56 billion to $70 billion by 2030. It is opportunistic ?? for multinationals and pharmaceutical companies seeking new sources of growth as developed markets stagnate, while patients will also have access to medicines previously unavailable on the continent.

In this context, Angola stands out as a leader in African development because it has capital from mineral assets, peace and a consolidated democratic regime, although it still struggles with common problems on the continent, such as corruption, elitism and political favouritism, besides not yet having a well-balanced currency and consistent foreign exchange reserves. Credit is still abundant, but indiscriminate and erroneous use has led to excessive caution in its granting by financiers.

There are challenges facing the industry that include the following, and are not limited to:

1) access to affordable finance;

2) access to technology and technical knowledge;

3) inadequate human resource capacity;

4) small fragmented markets and poor market intelligence;

5) fragmented and weak regulatory systems;

6) fragmented and weak procurement and supply chain systems;

7) policy inconsistencies between trade, industry, health and finance;

8) business-to-business linkages and collaboration;

9) low investment in research and development as well as intellectual property.

No single sector, government department or organisation can achieve these objectives.

Take the example below from the Confederation of Zimbabwean Industries (CZI)

Table A: Business environment affecting manufacturing companies, 2018

| Measure | Very negative | Negative | No effect | Positive- Very | Very positive |

| Forex access | 81 | 14 | 3 | 0 | 3 |

| Exchange Rate | 65 | 22 | 8 | 3 | 3 |

| Lack of Cash | 61 | 31 | 5 | 0 | 3 |

| Tax 2% on electronic transactions | 59 | 27 | 10 | 2 | 3 |

| Political instability | 54 | 35 | 7 | 4 | 0 |

| Corruption | 52 | 31 | 13 | 3 | 2 |

| Access to Finance | 43 | 28 | 18 | 6 | 6 |

| Ageing Equipment | 36 | 42 | 19 | 1 | 2 |

| Compatition from imports | 35 | 31 | 27 | 3 | 4 |

| Interest rates | 32 | 43 | 21 | 3 | 2 |

| Power cuts | 26 | 29 | 31 | 10 | 2 |

| Electricity rates | 21 | 31 | 37 | 8 | 3 |

| Enviromental requirements | 19 | 23 | 47 | 9 | 3 |

| Conformity assessment | 13 | 28 | 50 | 4 | 6 |

| Domestic demand | 12 | 20 | 15 | 39 | 14 |

| Minimum wage/labour regulations | 12 | 29 | 46 | 7 | 6 |

| Import restrictions | 9 | 4 | 34 | 27 | 27 |

Source: Confederation of Zimbabwe Industries (CZI), Manufacturing Sector Survey 2018, Table 75

One of the main risks to African development in general and pharma development in specific are the Free Trade Zones created by China in African countries. Without proper restriction, competition can assume unfair proportions. On the other hand, the presence of these zones can facilitate the import of inputs to the generic industry, since China dominates the API market.

The reduction of results in the country itself has led China to aim at Africa. The China Chamber of Commerce for Import and Export of Pharmaceuticals and Health Products (CCCMHPIE) commissioned a study titled 21 Country Profiles 56 that identified 21 countries in Africa with pharmaceutical manufacturing potential and highlighted vast opportunities for Chinese pharmaceutical companies to expand and relocate their manufacturing to African countries.

In the proper African environment, Egypt is a major producer and exporter of generics.

South Africa is active in the generics sector, something of API and R&D.

Morocco, Algeria and Tunisia are already moving towards autonomy in the production of generics.

East African countries from Ethiopia to Kenya, Tanzania and Uganda have all announced plans for large-scale generic industry. Even Chad is building a pharmaceutical plant with Egyptian assistance. Kenya is building an HIV drug factory with a capacity of billions of tablets/capsules. Tanzania has announced plans for five factories. Bangladesh’s Square Pharma announced its first investment in Africa with a billion capsules / tablets plant in Kenya.

Ethiopia has been an important hub for Chinese pharmaceuticals within the African continent, facilitated by Ethiopian Airlines’ transport network, built with the help of Lufthansa.

India is vying for the African market as well. It is even open to investment consortiums.

Currently, the main players in pharma investment in the African continent are:

1- Investment Consortia: Development Partners International (“DPI”), through its ADP III fund, CDC Group, a UK publicly owned impact investor, and the European Bank for Reconstruction and Development (“EBRD”) have joined forces in creating a financing platform, with an initial $750 million, to fund the development of the pharmaceutical industry in Africa. Its aim is to increase the availability and affordability of quality medicines and develop local production, reduce reliance on imported medicines across Africa and reduce the incidence of counterfeit products in the market. It will also seek to invest in high-growth, broad-based specialty generic assets across Africa in high-demand areas such as oncology, autoimmune diseases, diabetes, respiratory conditions and intensive care.

Exim Bank, meanwhile, funds the Indian Pharmaceutical Fund’s investment on the African continent, primarily by fighting counterfeiting.

2- International Finance Corporation: IFC, a member of the World Bank Group, is the world’s largest multilateral investor in private healthcare, managing an active portfolio of about $1.3 billion in healthcare investments. IFC’s investments in service providers, pharmaceuticals, and medical technology aim to promote greater access to affordable, high-quality healthcare.

3- Africa Healthcare Fund: IFC’s partners in the Africa Healthcare Fund are the African Development Bank, the Bill & Melinda Gates Foundation, and German development finance institution DEG.

4- Africa Healthcare Fund Managed by Aureos Capital, the fund will invest in healthcare SMEs, such as health clinics and diagnostic centres, with the aim of helping low-income Africans access affordable, high-quality healthcare services. The fund will produce about 30 equity and quasi-equity long-term investments, ranging from $250,000 to $5 million, in socially responsible and financially sustainable private healthcare companies. It will invest in a wide range of companies that offer:

● Health services (clinics, hospitals, diagnostic centres, laboratories);

● Risk pooling and financing vehicles (health management organisations, insurance companies);

● Distribution and retail organisations (eye clinics, pharmaceutical chains, logistics companies);

● Pharmaceutical and medical manufacturing companies;

● Medical education;

● Medical education providers.

REGIONAL GOVERNMENT AGENCIES/NETWORKS

AU Division of Health, Nutrition and Population

The African Union Division of Health, Nutrition and Population responds to vital generic health issues related to health policy and delivery systems, nutrition and other public health related issues and challenges that require a concerted and coordinated approach at continental level. The Division works closely with the Division of AIDS, TB, Malaria and Other Infectious Diseases (OIDs) and supports the harmonization and coordination of public health and health systems strengthening, including human resources for health, medicines, e-health and traditional medicine, as well as population, reproductive health and nutrition issues.

West African Health Organization (WAHO)

The aim of the West African Health Organization is to achieve the highest possible standard and protect the health of the peoples of the sub-region through the harmonization of Member States’ policies, pooling of resources, and cooperation. WAHO’s areas of focus are Maternal, Child and Adolescent Health; Quality Standards and Centres of Excellence; Pharmaceuticals (drugs and vaccines); Prevention and Control of Communicable and Non Communicable Diseases; Health Information.

Africa Regional Network

www.healthsystemsglobal.org/regional-network

The Africa Regional Network is a group of Africa-based HPSR networks, connecting with the aim of learning what each is doing in the field, building synergies, raising the profile of African Health Policy and Systems Research (HPSR) and seeking ways in which the region can shape and influence the wider Global Health Systems (HSG) society.

WHO Regional Office for Africa

The WHO Regional Office for Africa is one of 6 WHO regional offices worldwide. It serves the WHO African Region, which comprises 47 Member States with the Regional Office in Brazzaville, Republic of Congo. Its work involves translating global health initiatives into regional plans that respond to the specific needs and challenges of countries in the Region. It supports countries to achieve better health outcomes through technical and policy advice, development of norms and standards, generation and sharing of knowledge and convening of health partners. Together with countries, they achieve health objectives by supporting national health policies and strategies.

NATIONAL GOVERNMENT AGENCIES AND NETWORKS

The Medical Schemes Council (South Africa)

The Council for Medical Schemes is a statutory body established by the Medical Schemes Act (131 of 1998) to provide regulatory oversight of private health financing through medical schemes. The governance of the Council is exercised by a Board appointed by the Minister of Health, comprising a non-executive Chairman, Vice-Chairman and 13 members. The Chief Executive of the Board is the Registrar, also appointed by the Minister. The Board determines overall policy, but day-to-day decisions and management of staff are the responsibility of the Registrar and Executive Managers. The Council for Medical Schemes oversees an industry of over 80 registered medical plans in the country.

South African Health Products Regulatory Authority

SAHPRA is an entity within the National Department of Health (NDoH). SAHPRA took over the functions of the Medicines Control Council (MCC) and the Radiation Control Board (DRC). Subsequently, SAHPRA was established as an independent body reporting to the National Minister of Health through its Board. SAHPRA’s mission is to regulate (monitor, evaluate, investigate, inspect and register) all health products. This includes clinical trials, complementary medicines, medical devices and in vitro diagnostics (IVDs). In addition, SAHPRA has the additional responsibility of overseeing radiation control in South Africa. SAHPRA’s mandate is outlined in the Medicines and Related Substances Act (Act No 101 of 1965 as amended), as well as the Hazardous Substances Act (Act No 15 of 1973).

INDUSTRY ASSOCIATIONS

South African Medical Technology Industry Association

The South African Medical Technology Industry Association was founded in 1985 and is the voice of the South African medical technology and in vitro diagnostics industry. SAMED is committed to ensuring a sustainable medical technology industry that improves patient access to innovative solutions. SAMED has grown considerably in recent years. Its members are companies – local and multinational – involved in the manufacture, import, sale, marketing and distribution of medical technologies in South Africa.

Innovative Pharmaceutical Association of South Africa

The Innovative Pharmaceutical Association of South Africa (IPASA) was established in April 2013. Spanning the entire pharmaceutical value chain – from development to manufacturing and distribution – IPASA supports initiatives in the public and private healthcare sectors to help develop practical solutions to meet the country’s most pressing healthcare challenges. IPASA currently represents approx. 43% of the country’s private pharmaceutical sector.

African Health Federation

The inaugural Africa Health Business Symposium held in Nairobi, Kenya from 5-7 October 2016 witnessed the unification of Africa’s five regional health federations to launch the Africa Health Federation, which will advocate, guide, collaborate and unify Africa’s private healthcare sector to ensure the expansion and strengthening of healthcare systems, stimulating greater investments, as well as the development of accessible, affordable and quality healthcare delivery across the continent, thereby elevating Africa to global standards.

South Africa Hospital Association

The Hospital Association of South Africa represents the owners and managers of the majority of private sector hospital beds in the country. HASA engages with various stakeholders to inform the legislative and regulatory environment, advocating for quality healthcare for all and contributing collaboratively to debates and discussions on healthcare reform, improvement and expansion.

RESEARCH CENTRES

Council for Scientific and Industrial Research (South Africa)

The Council for Scientific and Industrial Research (CSIR) is a leading scientific and technological research organisation that researches, develops, localises and disseminates technologies to accelerate socio-economic prosperity in South Africa. CSIR was established by an Act of Parliament in 1945 and the executive authority of the organisation is the Minister of Higher Education, Science and Technology. The organisation plays a key role in supporting the public and private sectors through targeted research.

South African Council for Medical Research

The South African Medical Research Council (SAMRC) was established in 1969 with a mandate to improve the health of the country’s population through research, development and technology transfer. The scope of the organisation’s research projects includes tuberculosis, HIV/AIDS, cardiovascular and non-communicable diseases, gender, and health and alcohol and other drug abuse. With the strategic objective of helping to strengthen the country’s health systems – in line with that of the NDoH, SAMRC constantly identifies the leading causes of death in South Africa.

Ifakara Health Institute (Tanzania)

Ifakara Health Institute (IHI) is a health research organisation. IHI’s work follows the entire research life cycle, from basic science to policy and translation. IHI is organised as follows: 3 research departments (environmental health and ecological sciences; clinical interventions and trials; health systems, impact assessment and policy); 6 research units (grants and contracts; training and capacity building; laboratories; data systems and platforms; vector control product testing; chronic disease clinics); and 7 technical units (internal audit; knowledge management & communications; financial management; HR; contract management; branch management and ICT).

Kenya Medical Research Institute

The Kenya Medical Research Institute (KEMRI) is a state corporation established through the Science and Technology (Amendment) Act 1979, which has since been amended to the Science, Technology and Innovation Act 2013 as the national body responsible for conducting health research in Kenya . KEMRI provides advice to the Ministry on various aspects of health care and care delivery. They have 7 regional clusters serving 47 counties. They conduct national disease surveillance and rapid response capacity for major disease outbreaks (Cholera, Chikungunya Virus, H1N1 Flu, Yellow Fever, Rift Valley Fever, Ebola, Aflatoxicosis etc.).

INDUSTRY PUBLICATIONS

Africa Health

Africa Health is a review journal and does not publish original articles. The journal seeks to cover a wide range of subjects from clinical care topics to health management, education and CPD programme structure.

Africa Health IT News

https://africahealthitnews.com

Africa Health-IT News (AHIT) is a UK-based non-profit organisation dedicated to promoting the use of technology in healthcare in Africa. Africa Health IT News (AHIT) focuses primarily on the needs of healthcare professionals and other stakeholders in Africa.

Medical Brief

The Medical Brief is Africa’s official weekly summary of medical issues, both on the continent and around the world. It provides succinct summaries of the latest developments in both news and research, with links to the original material.

www.health24.com

Health24’s content is educational, relevant and clinically reviewed. The site covers a wide range of topics, such as detailed information on common medical conditions, diet, fitness, pregnancy, parenting and mental health – even pet health.

Radiant Health Magazine

Radiant Health is a bi-annual print and digital magazine dedicated to African women and their journey to wellness through health, beauty and culture.

Medpharm Publications

Medpharm Publications was founded in 1988 and has established itself as the largest publisher of medical and pharmaceutical journals in South Africa. It has more than ten titles (over fifty journal issues). Medpharm publications reach over 40,000 healthcare professionals nationwide with print editions and have established a global audience with online editions.

Pharmaceutical manufacturing in Africa does not cover the needs of the pharmaceutical market. The continent as a whole has about 375 drug manufacturers, mostly concentrated in North Africa, South Africa, Kenya and Nigeria, to serve a current population of about 1.3 billion people, which is expected to double by 2050.

The disease burden in Africa has historically been related to communicable diseases, which account for two-thirds of the total disease burden. Most of the disease burden comes from HIV / AIDS (70% of people living with HIV are in Africa) and Southern Africa continues to be disproportionately affected.

However, non-communicable diseases are increasing across Africa. This is occurring in parallel with an increasing rate of urbanisation (from 27% in 1950 to 40% in 2015 and projected to reach 60% by 2050) and subsequent lifestyle changes. These changes are associated with an increase in risk factors such as hypertension, diabetes and obesity, as well as mental and neurological disorders. A World Bank report estimates that by 2030, noncommunicable diseases will cause more deaths in Africa than communicable diseases.

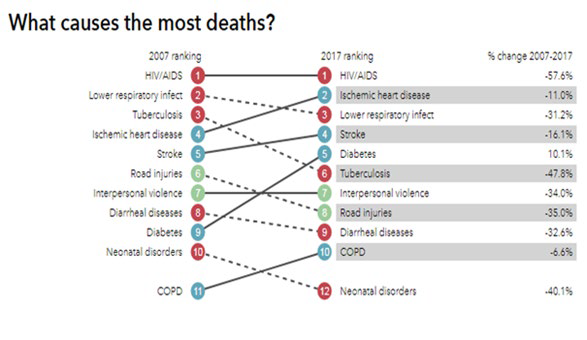

Figure 1: Causes of deaths in South Africa / Source: Institute for Health Metrics and Evaluation / Source: Institute for Health Metrics and Evaluation

The pharmaceutical industry in Angola: 32 million people

.

How many people in Angola?

With almost 36 million inhabitants and a female population of 50.5% and 49.5% men. According to 2014 census data:

➢ The average life expectancy is 52.7 years, with men’s being 51.2 and women’s 54.2 years;

➢ The adult illiteracy rate (over 15 years of age) is 34.4%;

➢ 47.2% of the population is under 15 years old and only 3.9% over 60 years old;

➢ 43.37% of the population is below the poverty line according to the PPP (Pursuit Parity Power at 1.25 USD per day).

Health Situation of the Angolan People

➢ Neonatal mortality is at 24/1000, infant mortality (under 5 years) is at 68/1000, childbirth mortality is at 239/100000;

➢ Only 49.6% of deliveries are attended by a medical professional;

➢ The ratio of doctors per inhabitant is 0.17/1000 and that of nurses is 1.66/1000;

➢ 3.31% of GDP is allocated to health and 35.74% of the total spent on medicine is of private origin;

➢ 38% of children receive only breast milk until they are six months old;

➢ 31% of one year old children received triplet (DTP 3) immunisation;

➢ Angola is a country vulnerable to outbreaks, such as yellow fever, malaria, cholera, zika. It is important to record events that overwhelm health services and compromise the life and health of its citizens;

➢ Communicable diseases are responsible for more than 50% of deaths recorded in the population. Despite the progress made in the last 15 years in neonatal, infant and maternal mortality (see statistical table), the challenges remain important;

➢ Malaria in Angola remains a major public health concern, being the leading cause of death, illness and absenteeism. It accounts for approximately 35% of clinical care, 20% of hospital admissions, 40% of perinatal deaths and 25% of maternal mortality (DNSP, Annual Report 2013 and PNCM-DNSP, IIMA Report 2011;

➢ TB has frequently experienced stock-outs of TB drugs during the past 2 years, decreasing diagnostic and therapeutic coverage. The annual reported incidence of pulmonary TB is 182.7 cases/100,000 population, the prevalence of TB (all forms) is 204.1 cases/100,000 population in 2017, with a total of 367 new cases of multidrug-resistant TB (MDR-TB) and 3,613 cases of TB/HIV;

➢ In noncommunicable diseases (NCDs), progress was made in the legal framework and law enforcement to restrict tobacco consumption, including through increased taxation;

➢ The HIV/AIDS prevalence rate is 2.1%, data varies within the country, with some provinces more affected than others, such as Cunene with 6.6, Cuando Cubango 5.5, Luanda 1.9, Cabinda 0.6;

➢ Population using clean drinking water sources (%) (Census 2014).

○ 13 (Rural);

○ 51.4 (Urban);

○ 36.1 (Total).

➢ Population using sanitary facilities (%) (2015)

○ 81 (Urban);

○ 60 (Total);

○ 25.9 (Rural).

HEALTH POLICIES AND SYSTEMS

➢ The health system in Angola is based on the Primary Health Care and Hospital Care Programme, which covers health services from the community level to a more complex level. It comprises 5 sub-programmes, namely:

○ (1) Promotion of healthy habits and lifestyles;

○ (2) Operationalising health services;

(3) Safe blood transfusion;

(4) Management and development of the national laboratory network; and

○ (5) Pre-hospital care.

➢The health needs and problems currently encountered by the NHS (National Health System) mainly relate to:

○ (i) insufficient coverage and poor maintenance of health centres;

○ ii) deficient reference and counter-reference system between the three levels of the NHS;

○ iii) limited human and technical health resources, in quality and quantity, and poor distribution of staff in rural and peri-urban areas;

○ iv) deficiencies in the health management system, including information, logistics and communication systems;

(v) scarcity of financial resources and poor financing model; and

○ vi) limited access to safe drinking water, sanitation and energy.

An ongoing government strategy to address the low coverage of health facilities and health promotion is the implementation of ADECOS (Community Development Agents) to support health promotion and promotion of other sectors community programs The National Health System comprises the National Health Service, which operates under the supervision and methodological guidance of the Ministry of Health and is managed by provincial governors and municipal administrators. The following five subsystems and complementary services are part of the national system:

○ The Health Service of the Angolan Armed Forces (DSS/EMG/FAA), which is the largest national partner of the Ministry of Health with regard to the community services of large public companies (SONANGOL, ENDIAMA and others);

○ The National Civil Protection Service (SNPC) of the Ministry of the Interior, which takes the lead in organising a response to natural disasters and emergencies, including public health emergencies. It is also responsible for health surveillance interventions organised by the National Police Force in areas related to supervision, economic activities and border control;

○ Profit-taking in hard-to-reach areas, logistical support for large-scale campaign activities and response to health emergencies;

○ – The health education subsystem, which covers technical and professional institutions as well as public and private medical schools;

○ – Private non-profit health care services (essentially run by religious institutions and NGOs). However, in recent years, the presence of international NGOs is being reduced.

COOPERATION FOR HEALTH

➢ The development of multisectoral health partnerships in Angola remains a key strategy, as it facilitates and accelerates critical interventions aimed at improving the health status of the Angolan population;

➢ Key partners in the health sector include Cuban cooperation, the World Bank, the European Union, the Global Fund, USAID, PMI, JICA and United Nations agencies. In addition, there are active partnerships with NGOs (National, Red Cross, World Vision, MSF, MENTOR, ADPP and others); civil associations; local and foreign companies, including oil companies; and regional organisations (SADC, CPLP, AU). The European Union, the World Bank and the Global Fund support the Ministry of Health’s programmes to strengthen the National Health System and implement the National Health Development Plan;

➢ These partners are providing relevant technical and financial support to the Angolan health sector, consistent with the national priorities defined in the National Development Plan 2013-2017 and the National Health Development Plan (PNDH) 2012-2025, which are the country’s main public policy implementation instruments.

DISTRIBUTION NETWORK

How many pharmacies do you have in ANGOLA? There is no data for all of Angola, but in greater Luanda there are 586 pharmacies and drugstores. Considering the total populations of Luando and the country, it can be assumed that there are no more than 8000 pharmacies, but that 5000 are a reasonable number.

to be rewritten

Pharmaceutical Manufacturing Plan for Africa (PMPA)

DEMOGRAPHIC BEHAVIOUR: AND DISEASES.

Africa suffers disproportionate disease with, for example, 75% of the world’s HIV/AIDS cases and 90% of malaria deaths. The population suffers more from tuberculosis than the rest of the world and there are many other contagious diseases that cause morbidity and mortality. The extreme impact of infectious disease is felt most in sub-Saharan Africa, while northern countries have disease profiles that are similar to industrialised countries, with cardiovascular disease, diabetes and cancer being public health priorities.

Non-communicable diseases are being increasingly prevalent in the rest of the continent and with demographic changes taking place that are predicted to overtake infectious diseases as the largest cause of death in Africa by 2030. These predictions reflect the changing way of life that is associated with economic prosperity, a future predicted for our continent in the coming years.

OPPORTUNITY: non-communicable diseases are overtaking cases of deaths by 2030, more than diseases thought to be contagious.

1. AIDS;

2. Tuberculosis.

3. Leprosy

4. Hepatitis

5. Scabies and other contagious skin diseases.

Diseases by European habits: THE VILLAINS OF SUGAR and TRANS FAT.

6. Cardiovascular diseases.

7. Diabetes;

8. Cancer (cancer coadjuvant drugs);

9. Hypertension.

WATER Diseases: Floods

10. Verminosis

11. Mycosis and leishmaniasis;

12. Dengue, Zika, Chikungunya.

13. Malaria: anti malaria, Yellow fever.

14. Cholera

Tropical diseases

15. Sleeping sickness

16. Chagas’ disease

17. Trachoma

● Manufacture of chemically pure sugars. Sweeteners, stevia;

● Manufacture of allopathic and homeopathic pharmaceutical specialties;

● Production of serums, vaccines, contraceptives;

● Development of herbal medicines;

● Transformation of blood and manufacture of its derivative.

● Manufacture of chemically pure sugars;

● Pharmaceutical preparations and intermediates for the production of pharmochemicals;

● Processing of glands and manufacture of their extracts;

● Manufacture of and preparations for medical diagnostics;

● Production of dressings, bandages, cotton, gauzes, impregnated with any substance;

● Manufacture of medicines that do not have the character of specialties (oxygenated water, tincture of iodine, etc.);

● Manufacture of veterinary and antiparasitic vaccines.

● Cosmetics, hygiene products, perfumery

The international cosmetics market among all circuits is estimated at US$90 billion, divided between make-up (19.3%), perfumes (54.7%) and other products (26%).

The seven new species of pharmaceutical business model

| Business model name | Habitats to which is adapted | Nature of value proposition | Distintinctive Competencies |

| The imatator Monster | Limited Choice of core social provision | Very low cost off-patent medicines with appropriate quality and service levels | Identify the products most in demand by institutional payers and poor self-payers then manufacture and distribute these products at the lowest possible cost consistent with minimum quality and service standards. |

| The Geniuses | Lazarus and Narcissus Advanced State Provision Pressured State | Advanced therapies that are proven to have better clinical outcomes than very low-cost generic alternatives | Identify the most profitable unmet clinical needs; discover and develop products to meet those needs. Demonstrate your clinical economic superiority to existing therapies and political support for their provision |

| The reliable manager | Stay Well S | Reliable medicines, nutraceuticals and related programmes that treat minor ailments and enable the maintenance of good health | Identify the most profitable opportunities to treat minor ailments and maintain health. Deliver branded therapies and programmes that are effective and reliable enough to command a premium market premium market compared to very low-cost generics. |

| The Disease Manager | Chronic Cost Containment | Complete therapy delivery and management for effective treatment management of chronic conditions at the lowest cost consistent with appropriate quality and service levels | Develop and manage reliable therapies and programmes to monitor and mitigate chronic conditions more cost-effectively than in-house state provision and with adequate quality standards |

| Lifestyle Manager | Mass prophylaxis | Providing and managing therapies and programmes that minimise the development of more serious conditions at the lowest cost and appropriate levels of quality and service | Identify the most profitable opportunities to reduce state health costs by preventing lifestyle-related conditions. Develop and deliver therapies and programmes that prevent these conditions more cost-effectively than in-house state provision and with appropriate quality standards. |

| The value selector | Value pockets | Innovative new medicines and adaptations of off-patent medicines that provide comparative context-specific value when compared to low-cost generics | Identify specific clinical or use contexts in which greater value can be created for institutional payers compared to current therapies. Commercialise new or reformulated therapies that meet the economic and clinical needs of these setting |

| The Health Concierge | Very rich | Providing and managing therapy and programmes that resolve non-life-threatening illnesses and maintain health more effectively than state-provided alternatives | Develop and manage comprehensive therapies and programmes that maintain health and solve minor problems more effectively and with a patient experience superior to the alternative provided by the state. |

Different capacities for each chosen habitat

| Chosen habitat | Distinctive capabilities |

| Very rich | Invent and develop treatments that cure or manage difficult to treat diseases with significantly greater efficacy than any other treatment. |

| Bem rico | Develop and implement patient management processes that maintain wellbeing and cure or control minor illnesses significantly more effectively than any other process. |

| Central State Provision | Manufacture and distribute treatments for diseases funded by institutional purchasers at the lowest possible cost consistent with quality standards. |

| Advanced Status Provision | Invent and develop treatments that cure or manage difficult to treat diseases and demonstrate comparative value to institutional buyers. |

PESTLE Methodology

P (Policy)

*Government initiatives drive health education and health insurance;

*Government subsidies and tax breaks for healthcare companies;

* Unforeseen political policy can hinder market growth;

*High government intervention and bureaucracy affect market growth;

*Political agendas affect health budget allocation .

E (Economics)

*Emerging markets attract investment;

*Globalization paving the way for joint ventures and FDIs;

*Health is a mandatory budget expenditure;

*Considered a necessary expense, to economic downturn has little impact;

*Reduction in consumer disposable income affects treatment;

*Inflation and rising interest rates affect market growth;

*Prices of medicines are also affected by the health of the economy;

*Reduction in the effectiveness of R&D investment in the pharmaceutical industry;

*Generic drugs are more affordable.

S (Sociology)

*Ageing global population;

*Busy and sedentary lifestyles increase the incidence of obesity, cancer and diabetes;

*Difference in social class results in varied access to health care;

* Increased health awareness and education.

T (Technological)

* Penetration of internet making consumers aware of innovative pharmaceutical drug treatment;

– New information and communication technologies;

– Social media for health;

– Personalised treatments;

– Direct-to-patient advertising

E (Environmental)

*Air and water pollution increase diseases such as cancer;

*Natural disasters pose risk of disease outbreak;

*Increasing incidence of viruses infecting hospitals;

* Growing environmental agenda and community awareness

L (Legal)

*Regulations on pharmaceutical drugs;

*Customs import and export duties on pharmaceutical drugs;

* Consumer protection laws

* Health insurance regulations

*Increasing litigation.

MARKET ENTRY STRATEGY

Basic directives: regularity of supply, reliability in the quality of the medicine, ease of payment, differentiated customer service, availability of the medicine for immediate delivery.

For this it is necessary to develop logistics, quality control, certification auditable by the consumer, stock, credit. However, not all these steps can be directly linked to the industrial activity itself, depending on outsourcing and sister companies with specific objectives, such as packaging factory, research and analysis laboratory, transport and logistics company, importer and exporter.

● Establish a local presence. To be able to compete with the other players in the industry, proximity to customers is crucial. This will allow monitoring of any new developments and identification of niches or gaps often left aside;

● Find and select reputable partners. Partner with local distributors, who know the industry well and can do the groundwork, as well as marketing the products to an existing market;

● Adopt flexible payment models. This allows more local businesses, who sometimes struggle with product costs, to preferentially work with our companies. For example, alternative financing where loans are made available to local businesses at lower interest rates. Extended term billing and consignment stock.

Targeted primary health care provides ???. Large public health facilities generally require a product to be in country before it can be accepted into their facilities. Therefore, it is crucial to target small and medium sized clinics, the private sector and grow in terms of reputation, which will pave the way for larger clients.

1- Generic formulas from Brazil. BRAND Ginga Generics.

2- Premium brand: we still do not have an assembled portfolio.

We should not measure the capital of a pharmaceutical company merely by its material assets. We can distinguish at least eight types of capital directly related to the concept of sustainable development:

Financial Capital;

Industrial capital

Intellectual capital

Social capital;

Environmental Capital;

Cultural Capital;

Capital in Human Resources and Relationships;

Capital in Ethics and Responsibility.

A part is evidenced as tangible capital, another part as intangible. While the old logic is concerned with the financial and tangible part of the company, the sustainable vision focuses on the issue of intangible elements, such as honesty, brand, principles, commitments, reliability, among others.

The market approach strategy can be divided into stages:

The first consists of occupying the essential products distribution segment, either by its own production of the largest range of products on the National List of Essential Medicines (ANNEX) authored by the Ministry of Health (Dec. Exec. 426/21 of September 6, 2021), or by logistics that allow the distribution of imported brands from other laboratories throughout the country. This second option is aimed mainly at drugs on the list protected by patents where local production is not possible and drugs whose consumption is so small that it does not justify industrial production.

Thus, the generic formulas will be the products that would drive the plant and cover its maintenance and all manufacturing costs. In the ABC cost accounting formula, the products will be scaled for marketing strategies, distribution, inventory among others.

In a second moment, it will be approached hygiene, beauty and perfumery products, based on market studies, trying to attend a distribution that moves us away from marginal costs and prices. The logic of these products is the maximum profit, different of the pharmaceutical products. The main function of these product lines is diversification so that we can guarantee health safety to Angola, at first, and to other countries in the region, at a later stage, following the example of what is happening in the USA and Europe in the post-COVID scenario.

For medical supplies (gauze, adhesive tape, scalpel), initially we will seek to produce in partnership with other industries in Angola, or by incubating new ones, whenever necessary. In return, we will ask for exclusivity of the use of our distribution logistics system and with our brand.

To implement the entire system of production, distribution and sales it is necessary to have adjoining companies, but independent and whose scope is not part of this business plan, but independent plans. These are:

● A packaging producer;;

● An analysis laboratory, with capacity for quality analysis and research. If possible, clinical analysis;

● An export and import company.

FINANCIAL STRATEGY:

Among the main challenges of this market is the volatility of the exchange rate and the scarcity of foreign currency for international purchases, so we must maintain a current account and credit abroad for eventualities, avoiding shortages.

As the risk of default of pharmacies and delays in payments from the government, diversification and balance in the supply for these two sectors is essential, except guaranteed subsidy ?? explain better ??.

It is also necessary to have direct control over the stocks consigned to distributors, so that collection is guaranteed or immediate. Credit should only be taken when under third-party guarantee, i.e., in this case, facilitating the retailer to renew his stock. Stock control, collections, purchases will be done online, and managed in real time.

Also, diversified on the perfumery, hygiene and beauty product lines, besides the distribution on the pharmacies and drugstores associated, also on market and supermarket nets, door to door sales, if possible taking advantage of the zungueiras and giving them training and conditions to act profitably on the sector, as AVON, JEQUITI among others do on the market, or on the traditional way in which these zungueiras are part of the tradition.

Our price policy is to keep our products in competitive conditions with imported products and other competitors.

SOCIO-CULTURAL STRATEGY:

I am opening a parenthesis here for the Zungueiras, so that we can value a traditional aspect and cultures of Angola and also consolidate an economic improvement for the low income population, through this social project with and through them. This is an example of the capitals: social, cultural, human resources and relationships that we mentioned above.

Another initiative, in line with these objectives, is the research of the traditional medicinal herbarium, for the purposes of registration, for the joint benefit of the communities that hold this knowledge and investments in the improvement of health, education and sanitation in them.

We also intend to offer hygienic and prophylactic products in the population’s food baskets to combat diseases related to water, vectors and hygiene. Such as oral hygiene kits, mosquito repellents, chlorine kits for drinking water and fresh food washing, etc. All prepared for distribution, either by governmental, NGO or own initiatives, as a company policy.

Finally, it is our interest to invest in the research and development of oral rehydration serum and Ready-to-use therapeutic foods (RUTFs). We consider that the current recipe is extremely unhealthy as it is full of saturated fat, developed from a North American diet. We can develop RUTFs with better quality and from African production and diet.

Disease prevention education. Health risk management is a social concern of ours and as far as possible, our marketing will try to distribute recommendation for preventive health actions in our retailers.

INDUSTRIAL STRATEGY:

There are rare drugs whose consumption requires daily production, and also rare ones that need exclusive equipment for their production. In this way, the machinery will be dimensioned for the interchange of products, safeguarding the hygiene between one production and another, within the safety standards, thus producing a greater spectrum of drugs with a rational and economical machinery structure. Also making use of stock and consumption fashion curve.

Any unusual behaviour in the average consumption will also be foreseen, such as epidemics or seasonality of diseases, e.g. a higher incidence of respiratory diseases in drier seasons, a higher incidence of flu in colder seasons, etc…

The production will initially be concentrated in one industrial pole, but the increase will be studied according to future expansion strategies.

ENVIRONMENTAL STRATEGY:

Sustainability is the main key to our environmental strategy, based on clean energy autonomy and a program for the disposal of waste water and solid waste, with a double advantage, reliability and cost.

Among many initiatives, the collection of water from artesian wells, the installation of energy through pyrolysis processing, in which solid waste is transformed into energy without emitting greenhouse gases and producing fertilizer. It is also part of a consortium with other business initiatives.

STRATEGY FOR INTELLECTUAL CAPITAL AND HUMAN RESOURCES:

Angola is a country that has a shortage of cadres with specific training, which does not mean there are no exceptions. There is also the brain drain problem, which is the exodus of the best minds to developed countries. There is no way to maintain sustainable production without investment in the training of professionals and incentives to prevent their migration to more developed countries. It is not about a salary policy, as many think, but about investing in a pleasant and stimulating work environment, in the guarantee of a quality of life and, mainly, in strong friendship and camaraderie bonds that fix the worker with the surrounding society. The key words are belonging, appreciation, familiarity and welcoming.

Therefore, the HR department has a function much more than selecting personnel and managing labour obligations. It must have a continuous work of consolidating interpersonal relationships, respecting the culture and conviction of each one. Continuous training should not be limited to specific knowledge of the productive activity, but also to the improvement of relations between workers.

ETHICAL STRATEGY

We have to make it clear that our commitment is not only to financial profit. It is to be an industry inserted in the Angolan and African context and to have a responsibility in the construction of a better and sustainable future for the population. We are committed to health, not disease, so maintaining strict quality control, not using formulas whose effectiveness has not been tested and remaining in constant monitoring to detect any side effect not reported in previous research is our main commitment. To this end, we are completing a quality analysis laboratory detached from the industrial activity as an external audit on the quality and efficacy of our medicines.

A strategy that guarantees our image of reliability, quality and social commitment, in addition to availability in several points of sale in the country, intend to conquer an ethical capital that reflects in the election of the brand as preferred by the consumer. In other words, ethical capital is one of our differentials when approaching the market.

Marketing Strategies

STRATEGY 1

The Industry will be at the central point, where medicines and cosmetics will be manufactured.

There will be storage sites for regional medicines and cosmetics to improve the speed of supply, especially for those medicines whose consumption is rare and therefore do not justify stock in pharmacies or hospitals.

These storage sites will seek to be in isochronous points of the regional service areas, initially planned in a total of 7 sites in Angola, i.e. in the provinces of Cabinda, Benguela, Lubango, Malange, Cuando Cubango, Bié and Cunene.

STRATEGY 2:

Direct marketing.

Pharmaceutical companies worldwide spend most of their marketing investments on DIRECT Selling.

Direct selling to doctors who prescribe drugs and refer patients to them, i.e. laboratory representatives.

Our direct sale channel for beauty products, hygiene and perfumery will be the development of the Zungueiras.

Why will they distribute? Because they will move from the line of misery to common human life. Worthy of survival. We will use technology from the Brazilian SEBRAE to implement the action plan, set up the complete system of direct selling, commission system, buying and selling system, rules, training, characterization, remuneration, among others.

STRATEGY 3:

Sale of fractionated medicines

Medicines that may be used in fractions shall be packaged in such a way as to ensure that they can be fractioned without damaging the packet, and each fraction shall contain a reference to the product’s quality safety data, such as expiry date, batch and safety against falsification. Medicines whose continued use is mandatory, such as antibiotics, medicines for the control of diabetes and high blood pressure, shall not be sold in fractionated form.

STRATEGY 4:

Anti-counterfeiting measures.

It is our intention to use a modern graphic industry, capable of producing laser printing of holograms, codes revealed by scratching, etc…

Boxes of medicines and fractions should have a ‘sign’ of authenticity, which can be checked by mobile phone application or at the point of sale.

STRATEGY 5:

Government Procurement.

Participate in public tenders (bidding) offering differential delivery reliability and regularity. Tenders are an excellent opportunity to maintain new stock in the country.

Purchase in pharmacies and drugstores:

Our proposal includes that each retailer has a terminal to control stock, consumption and proof of authenticity of the medication. This terminal will allow us to control retailers’ stocks and control the consumption of drugs for continuous use, sending replacements, collecting payments in real time and paying retailers’ profits, guaranteeing cheaper credits, and allowing the client to check the authenticity of the drug at any time, even in fractionated form, through individualized registration for each fractionable drug read by proprietary technology (also checkable by mobile phones with the ability to read QR CODE.

STRATEGY 6:

ATYPICAL DISTRIBUTION CHANNELS. Structured within Angolan geography and culture.

Distribution logistics is a key point for the success of the company, we chose to outsource or create an independent structure to operate this logistics and transport. Only to move the raw materials to the industrial facilities, 25 carts with a cargo capacity of a 40-foot container would be necessary. However, the distribution to the network of pharmacies, drugstores and health centres, besides the sales posts of cosmetics, perfumery and hygiene products do not justify the displacement of such a large volume. They are more compatible with short trunk trucks and vans.

In 2019 there were 1675 Health Posts, with a projected increase to 3900 soon, 471 health centres and projected 1100, 166 Municipal Hospitals and projected 380 units, 75 maternity hospitals and projected 120 and 24 general and specialised hospitals and projected 50. A package of inputs and standard medicines must be delivered regularly for each one, according to its nature and specificity. There are about 3000 pharmacies and drugstores spread across the country, almost all of which suffer from shortages and irregular supply.

Actions in pharmacies:

Design: Part of the lot is a usual PHARMAK KIT, part is medication for continued use, made available to the patient at the pharmacy counter of their preference.

In the restructuring of the pharmacy, there should be a standardization of gondolas, counters, pharmacy layout to have pharmacy presentation. The INTERNAL LAYOUT should be recognized as belonging to our distribution network.

We also design minimal management software for the pharmacy, integrated as or with ?? our logistics and sales centre. This should be done so that minimum stocks are replenished, that there is availability of continued use medicines. In addition, analysis and monitoring of possible endemics, pandemics by geographical consumption charts.

Products

The WHO list of essential drugs, as well as that prepared by the Ministry of Health of Angola, contains a number of medicines and hospital supplies that do not necessarily reflect our production, which includes generic drugs, hygiene, perfumery and beauty products mainly. Thus, the main reasons for not producing are: ???

● Patented drugs;

● Medicines with Active Ingredients not Available in the Market;

● Medicines whose low consumption makes production uneconomical;

● Vaccines, at least at this first moment;

Surgical and ambulatory instruments;

Hospital furniture, among others.

However, some products not listed may be added to our judgment of opportunity, such as new drugs, food and vitamin supplements, reagents for clinical analysis laboratories, etc…

List of Essential Medicines according to the Angolan Ministry of Health:

| Abacavir (ABC) oral solution 20 mg/ml (sulphate) |

| Abacavir(ABC) tablet (dispersible) 60 mg |

| Abacavir(ABC) tablet 150GM |

| abacavir/lamivudine (abc/3tc) tablet (dispersible) 60 mg+30 mg (sulphate) |

| abacavir/lamivudine (abc/3tc) tablet 600 mg +300 mg (sulphate) |

| norethisterone acetate (or enanthate) oily solution 200 mg/ml in 1 ml ampoule |

| Medroxyprogesterone acetate solution for injection retard 150 mg/ml in 1 ml ampoule |

| Medroxyprogesterone acetate tablets: 5 mg |

| Solution for injection medroxyprogesterone acetate + oestradiol dihydrochloride: 25 mg + 5 mg |

| acetazolamide tablets: 250 mg |

| acetylcysteine solution for injection 200 mg in 10 ml ampoule |

| acyclovir oral suspension 200 mg/5 ml |

| acyclovir tablets 200 mg |

| acyclovir powder for injection 250 mg (sodium salt) in a vial |

| acyclovir ointment 3% P/P |

| acyclovir eye drops: 0.3% (sulphate) |

| topical acetic acid: 2%, in alcohol |

| acetic acid nasal spray: 100 micrograms per dose |